37 how does credit card processing work diagram

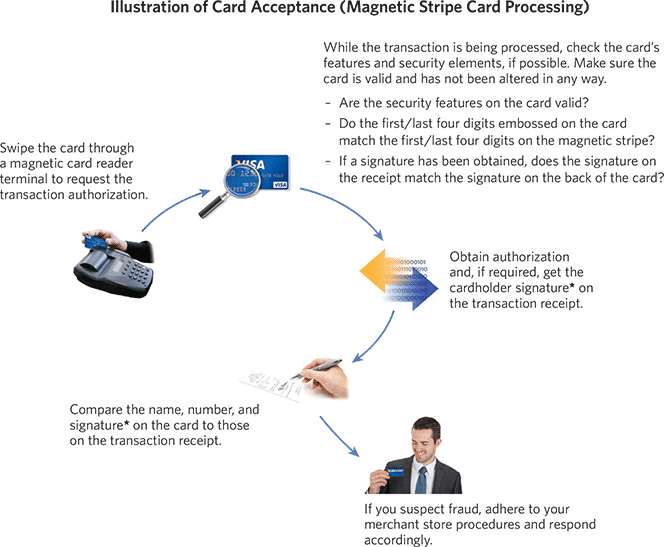

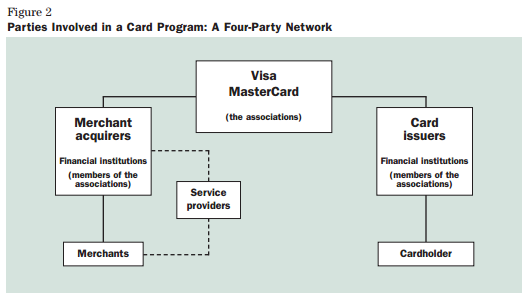

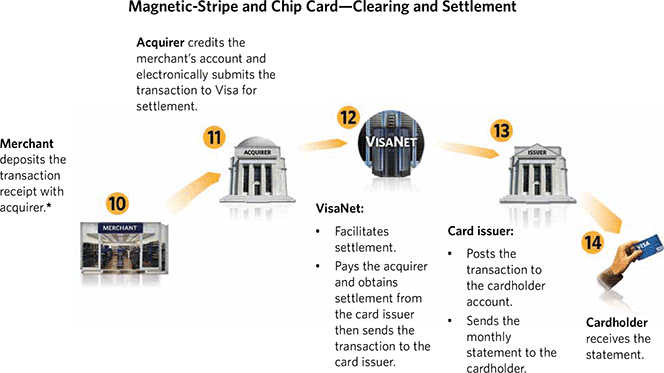

A simple credit card transaction can be processed through many different platforms such as e-commerce stores, wireless terminals, and also mobile devices. The whole process of swiping the card to the receipt produced takes place with few seconds. We have simplified the whole process into three stages 1. Authorization 2. Authentication 3. the credit card issuer receives the transaction information from the acquiring bank (or its processor) through banknet or visanet and responds by approving or declining the transaction after checking to ensure, among other things, that the transaction information is valid, the cardholder has sufficient balance to make the purchase and that the …

Credit card processing fees. One major consideration in choosing a credit card payment processor is the cost. Credit card processing fees vary for every vendor, and some pricing structures will work for you while others may work against you. Credit card processing fees (or merchant discount rate) may be charged in a few ways:

How does credit card processing work diagram

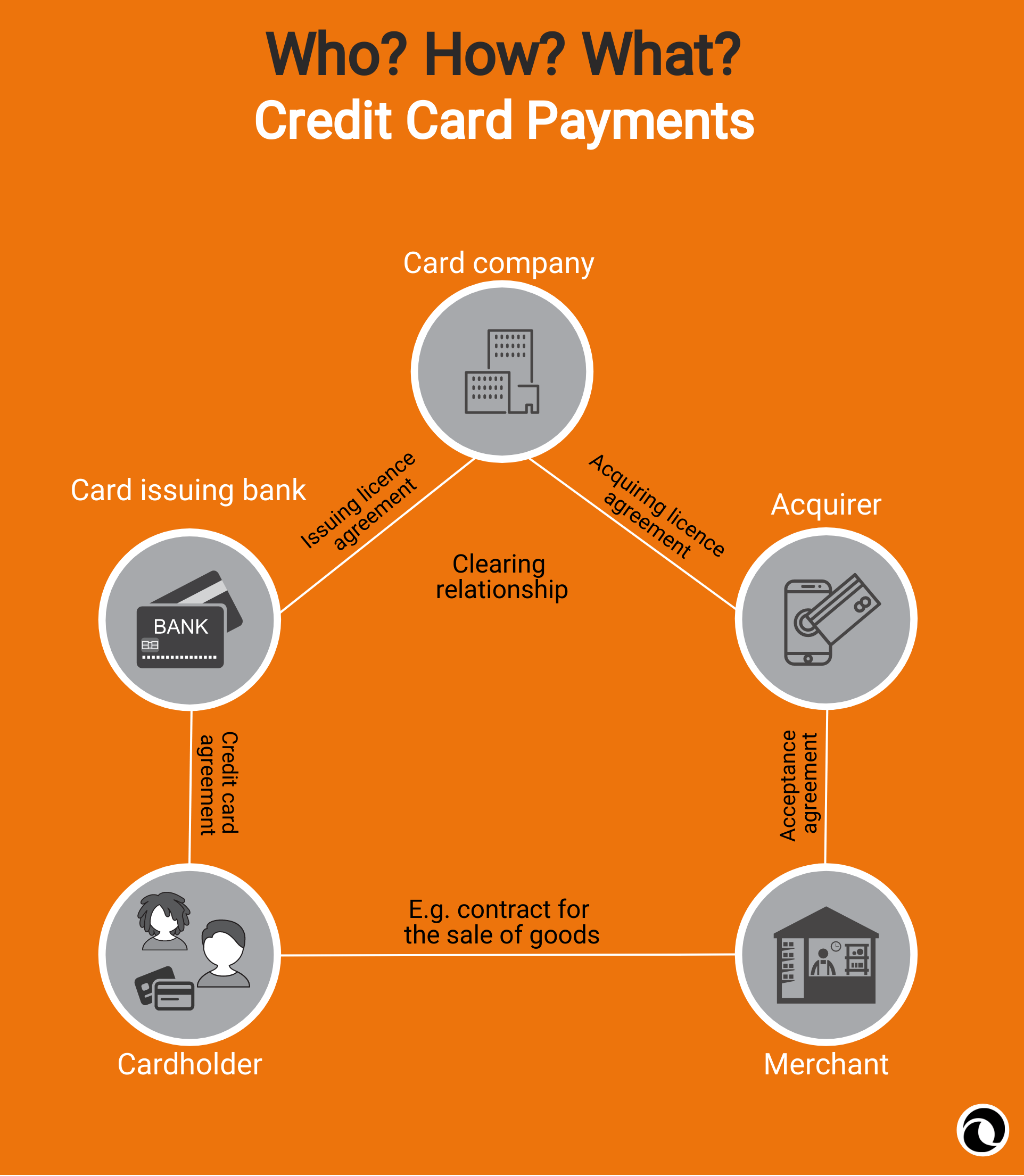

Most businesses rely on credit card processors to handle the details of accepting credit and debit cards. Credit card processing is a critical service—it ensures that customers can simply and quickly checkout. This quick overview will help you understand the basics of credit card processing. How does credit card processing work? First, a ... · Processing Credit Card in Personify (Overview) This diagram displays the overall flow of data when processing a credit card in Personify. The process begins with the creating an order and selecting the credit card payment method. · Pre-Validating Credit Cards Credit Card Transaction Process Stage 1: Authorization In the authorization stage, the merchant must obtain approval for payment from the issuing bank. The cardholder presents their credit card for payment to the merchant at the point of sale.

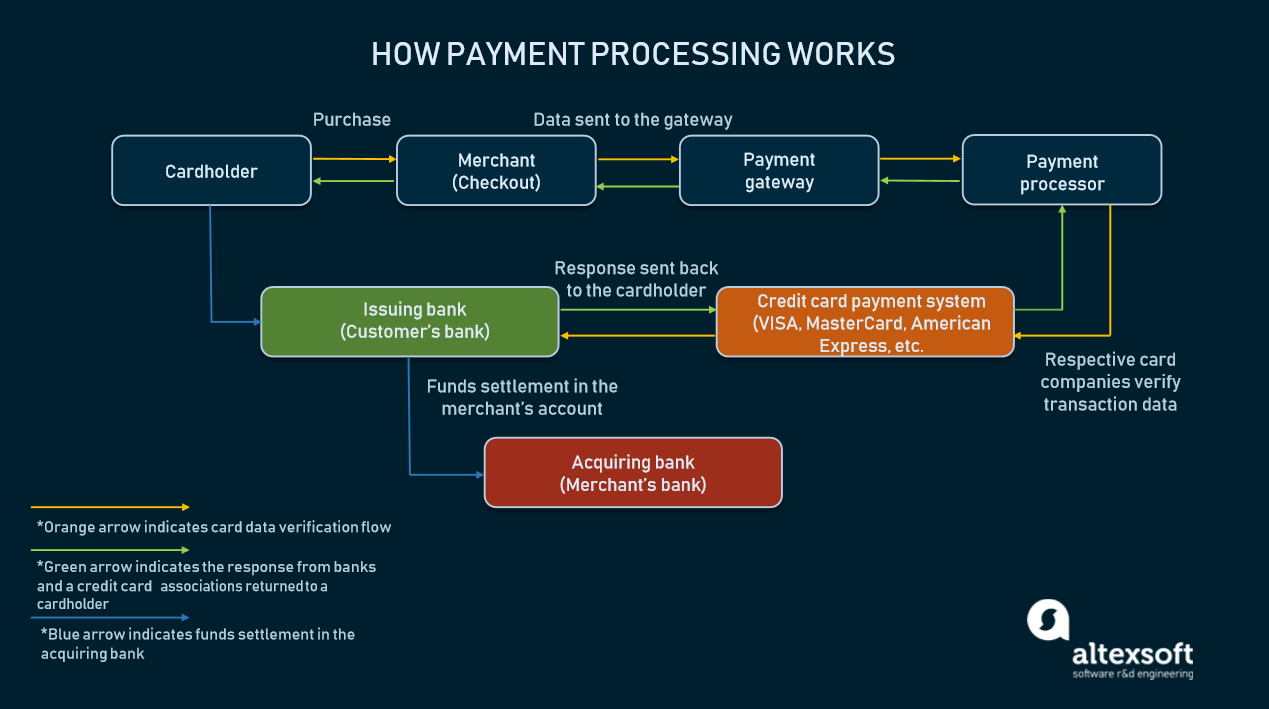

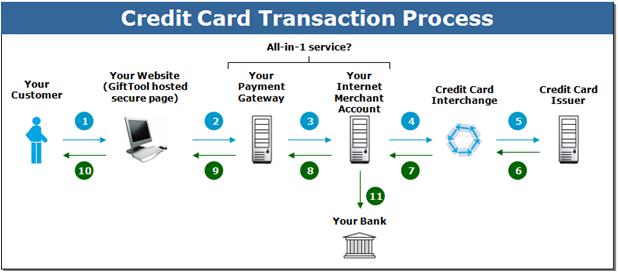

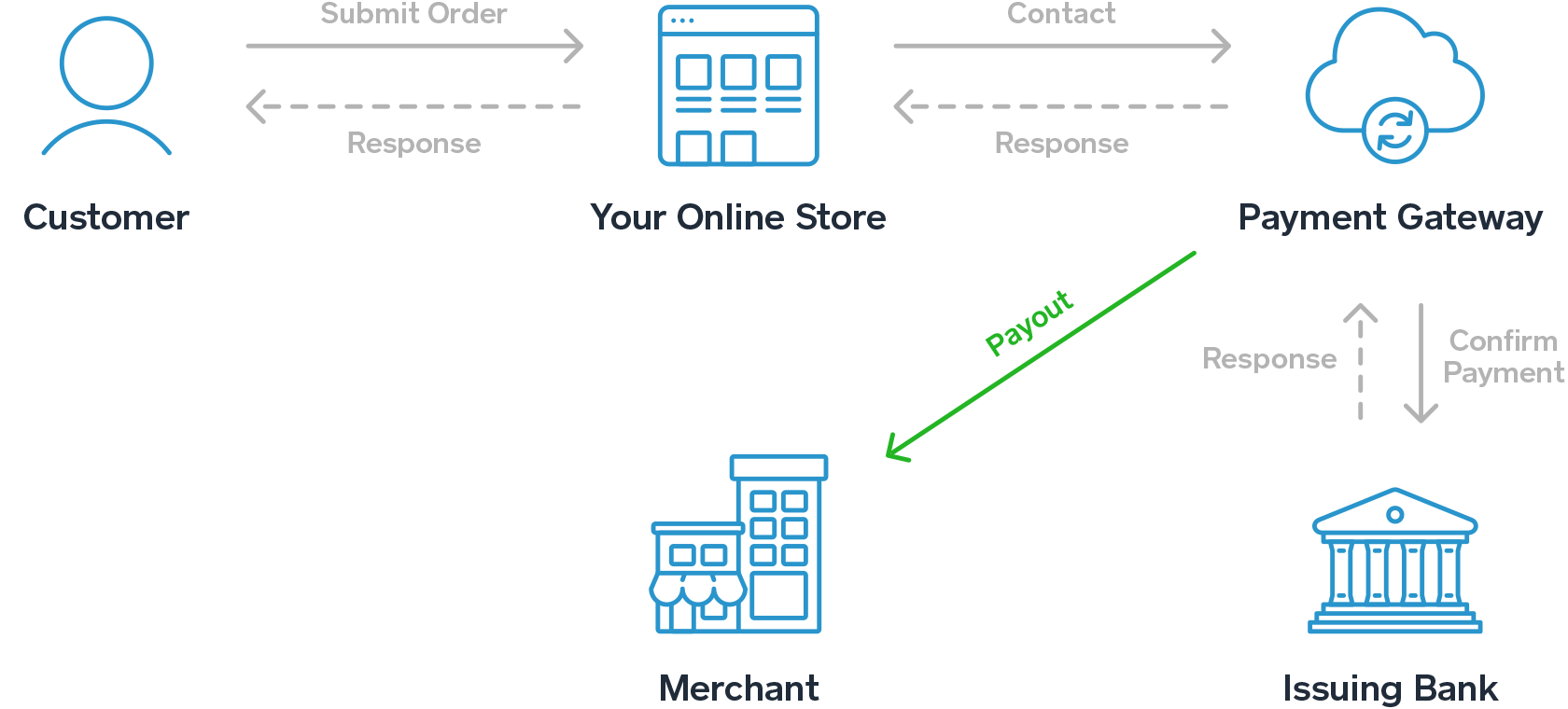

How does credit card processing work diagram. The processor immediately submits you to what is known as the credit card interchange (-.09¢). After you've cleared the interchange, your next leg takes you to the issuing bank (-1.93¢), which verifies the available funds in the customer's credit card account. Whether you are approved or declined, you now begin the journey back to the customer. The authorization process goes roughly like this: 1. Your customer buys an item on your site with a credit or debit card. 2. That information goes through the payment gateway, which encrypts the data to keep it private, and sends it to the payment processor. 3. Offer helpful instructions and related details about How Does Credit Card Processing Work - make it easier for users to find business information than ever. Top Companies. Suntrust Bank Icon Desktop Add Huntington Bank To Desktop Regions Bank Icon For Desktop ... The electronic credit card payment process may be difficult to understand at first. The diagram above illustrates the flow of payment information and funds from your GiftTool web pages to your bank account. Your Customer submits their online transaction & credit card information to the GiftTool secure servers. If data is missing, GiftTool sends ...

The bank then gets authorization from the credit card network to process the transaction. Your card issuer then has to verify your information and either approve or decline the transaction. If the... Credit card processing works in three distinct processes: Authorization Settlement Funding First, let's look at the authorization process. The cardholder presents their card (or other secure method) to a merchant in exchange for goods or services. How the Credit Card Transaction Process Works for Merchants. For consumers, making a credit card purchase seems like a pretty simple exercise. Behind the scenes, though, the credit card transaction process is far more complex than it looks at first glance. This payment processing guide provides a clear, concise, and complete look at how businesses accept and process payments. It offers valuable information on topics such as interchange fees, PCI compliance, and mobile payments. Read a summary of our Credit Card Processing 101 summary below + download the complete PDF here.

Khan Academy shares this great informative video about who's who in the world of credit card processing and what role the processor plays in your business. eCommerce merchants looking for credit card processing services and a payment gateway for their business will find Stripe hard to ignore. One of the largest and most established providers in the world of online payments, the company serves as both a payment service provider (PSP) and a payment gateway provider. With Stripe, you can accept credit cards, debit cards, and even automated clearing ... Credit Card Order Process Flowchart. If your organization accepts credit cards you know how important it is to have this process laid out clearly. Instead of trying to create a credit card order process flowchart from a blank canvas, use the flowchart template provided in SmartDraw and build from there. 10/32 EXAMPLES. When you write a check, the payee deposits the check to his or her bank, which then sends it to a clearing unit such as a Federal Reserve Bank. The clearing unit then debits your bank's account and credits the payee's. From there, the check returns to your bank and is stored until it's destroyed. Electronic/Check 21 Method: Nearly all ...

A lot of merchant services providers can reprogram your credit card machines to work with their solutions. Some payment processors — including Payment Depot — will even do it for free. So if you're shopping for a credit card processor and you have existing terminals in place, don't forget to ask about reprogramming. Your location

Offer helpful instructions and related details about Credit Card Payment Processing Flow - make it easier for users to find business information than ever. Top Companies. Top Credit Card Processing Suntrust Bank Icon Desktop Add Huntington Bank To Desktop ...

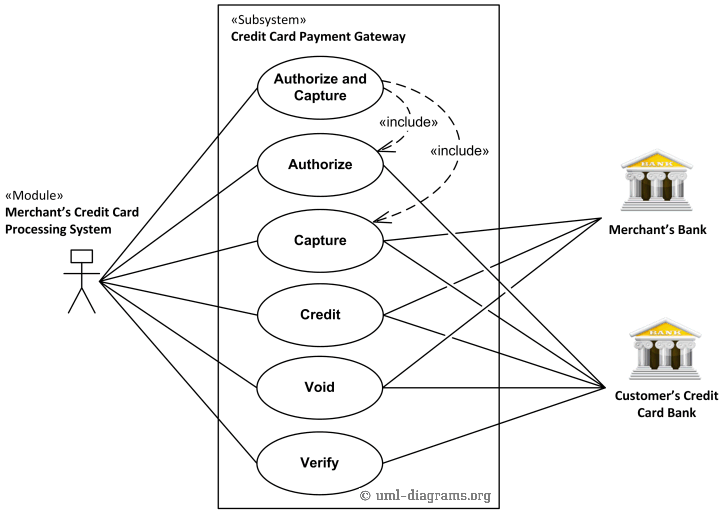

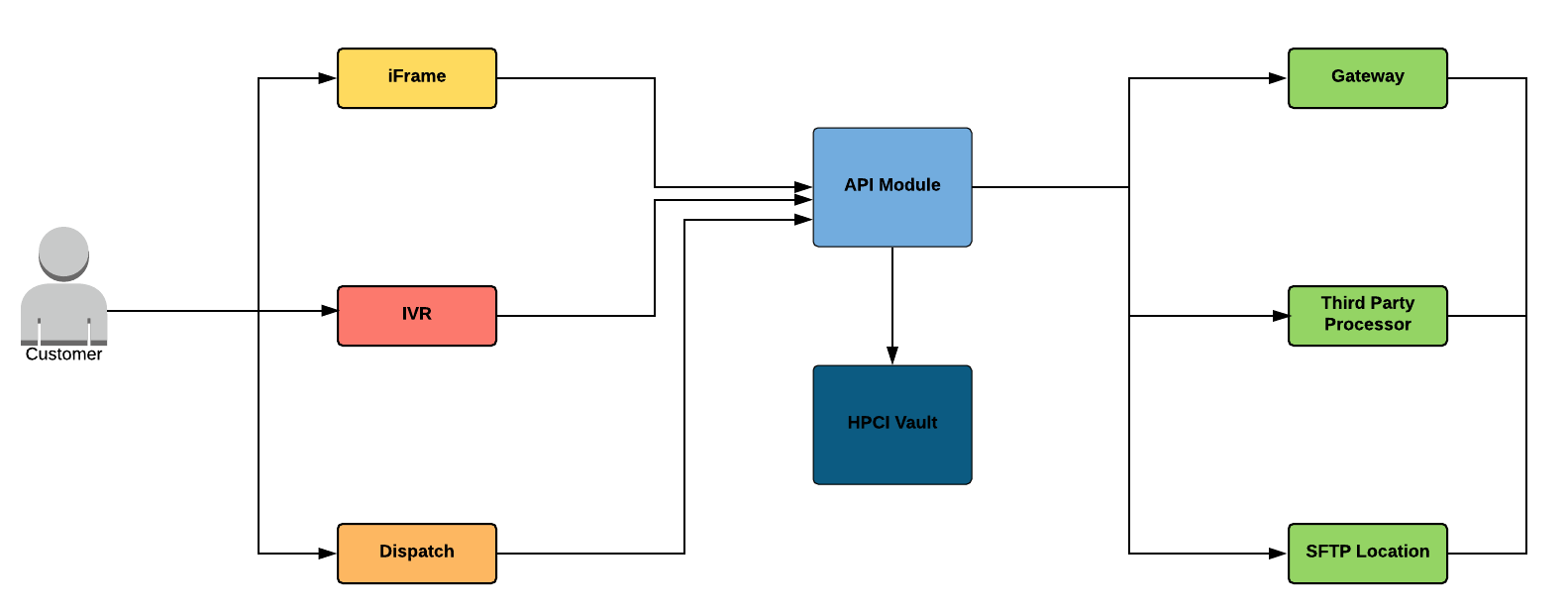

Credit Card Processing System UML Diagram. This sample shows the Use Case Diagram of the credit card processing system. You can see how the payment by credit card occurs. This sample can be used by the bank, financial enterprises, for understanding the work of the credit card processing system at the projecting the banking systems.

Credit Card Processing System UML Diagram. This sample shows the Use Case Diagram of the credit card processing system. You can see how the payment by credit card occurs. This sample can be used by the bank, financial enterprises, for understanding the work of the credit card processing system at the projecting the banking systems. How Does Credit Card Processing Work Diagram

How credit card payments work ; How credit card payments work. Learn about the three basic steps in the credit card processing cycle, made easier with us. Questions? Call 1-888-323-4289. Three steps in the payment process. Authorization.

The processor routes the transaction to the consumer's payment card-issuing bank to request transaction authorization. The issuing bank (issuing the payment card for Discover or American Express transactions) authorizes or declines the transaction. CyberSource returns the response to the merchant.

The customer swipes or inserts a credit card. The cardholder initiates payment using the merchant's card reader, usually provided by the ISO. The transaction is sent to the processor. The ISO communicates the transaction information to its Payment Processor. The transaction is relayed to the network.

Figure 1: The flow of an NFC payment . Customer tokenizes card: A customer adds their card to Google Pay.Then, their mobile device stores a payment token that is encrypted using a limited / single-use key.; Merchant receives token: When the customer taps their device on an NFC-enabled terminal at the store's point-of-sale, the device sends the token, token expiry date, and cryptogram to the ...

Credit card information is sent to the Payment Gateway via a secure channel The Payment Gateway routes the credit card to the appropriate Internet Merchant Account Internet Merchant Account connects to the Merchant Account for credit card processing. The result is passed back to the Gateway and then the application.

Credit Card Basics How Do Credit Cards Work? Put simply, a credit card is a type of loan: the bank or credit card issuer extends you a line of credit — money that you otherwise would not have. In exchange, you pay them back by the monthly payment due date.

In eight simple steps, we'll give you the basics on how credit card merchant processing works. Read below. 1. Making the purchase. The customer finds a product that he or she likes and decides to make the purchase. The customer can use a credit card to pay for the item in the store, through an online payment gateway, by phone, or by mail. 2.

Credit Card Transaction Process Stage 1: Authorization In the authorization stage, the merchant must obtain approval for payment from the issuing bank. The cardholder presents their credit card for payment to the merchant at the point of sale.

· Processing Credit Card in Personify (Overview) This diagram displays the overall flow of data when processing a credit card in Personify. The process begins with the creating an order and selecting the credit card payment method. · Pre-Validating Credit Cards

Most businesses rely on credit card processors to handle the details of accepting credit and debit cards. Credit card processing is a critical service—it ensures that customers can simply and quickly checkout. This quick overview will help you understand the basics of credit card processing. How does credit card processing work? First, a ...

0 Response to "37 how does credit card processing work diagram"

Post a Comment