37 cash flow diagram calculator

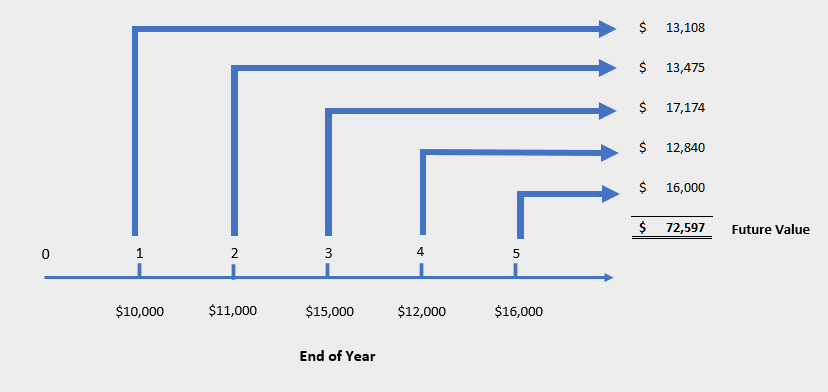

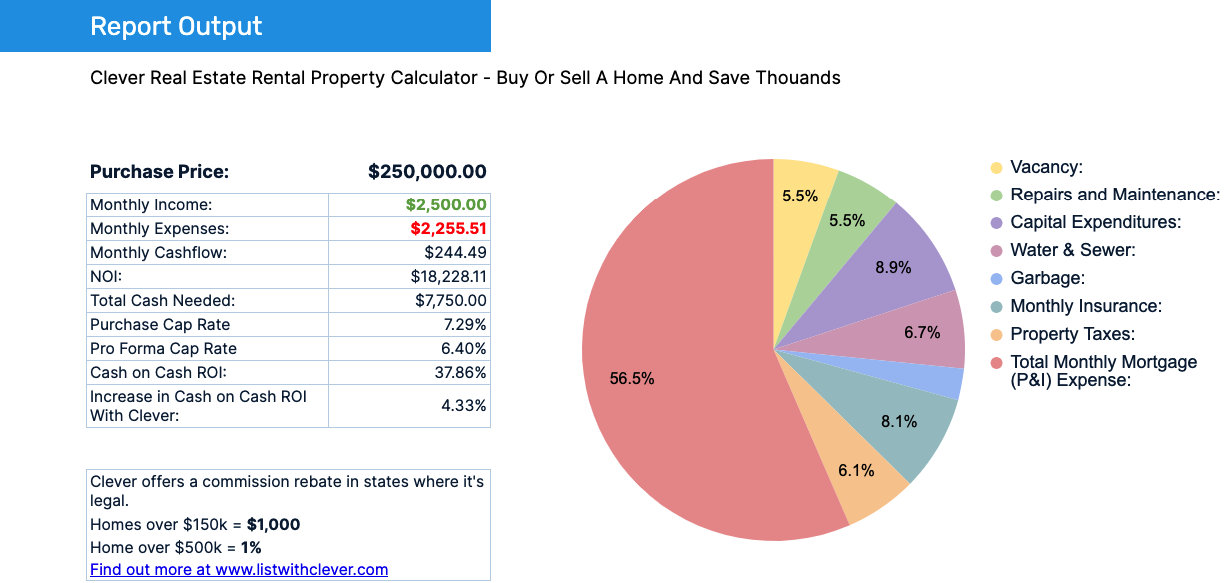

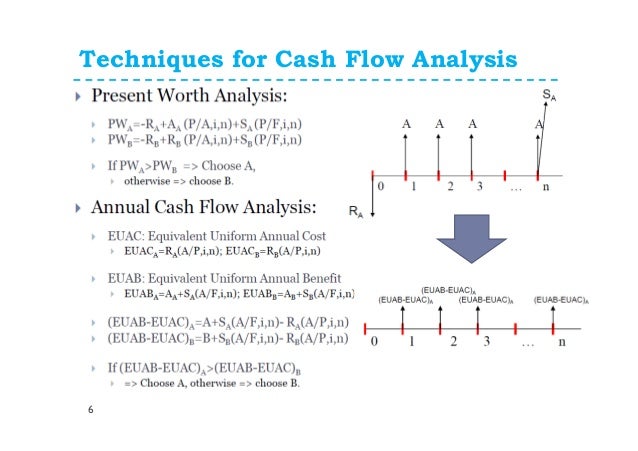

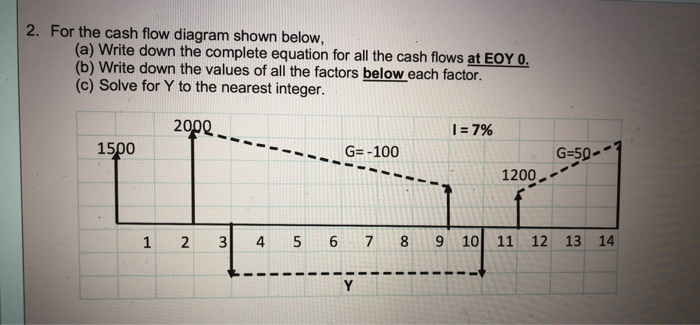

F V = P V ( 1 + i) n. Substituting cash flow for time period n ( CFn) for PV, interest rate for the same period (i n ), we calculate future value for the cash flow for that one period ( FVn ), F V n = C F n ( 1 + i n) n. If our total number of periods is N, the equation for the future value of the cash flow series is the summation of individual ... CHECKING (calculation verification) CHECK #1 CHECK #2 CHECK #3 CHECK #4 [See Guidelines worksheet for details] ANALYZE the relationship between the cash flow and the projected profit during the period in question. The estimated profit is the difference between the estimated change in assets and the estimated change in liabilities before such ...

In order to calculate NPV, we must discount each future cash flow in order to get the present value of each cash flow, and then we sum those present values ...

Cash flow diagram calculator

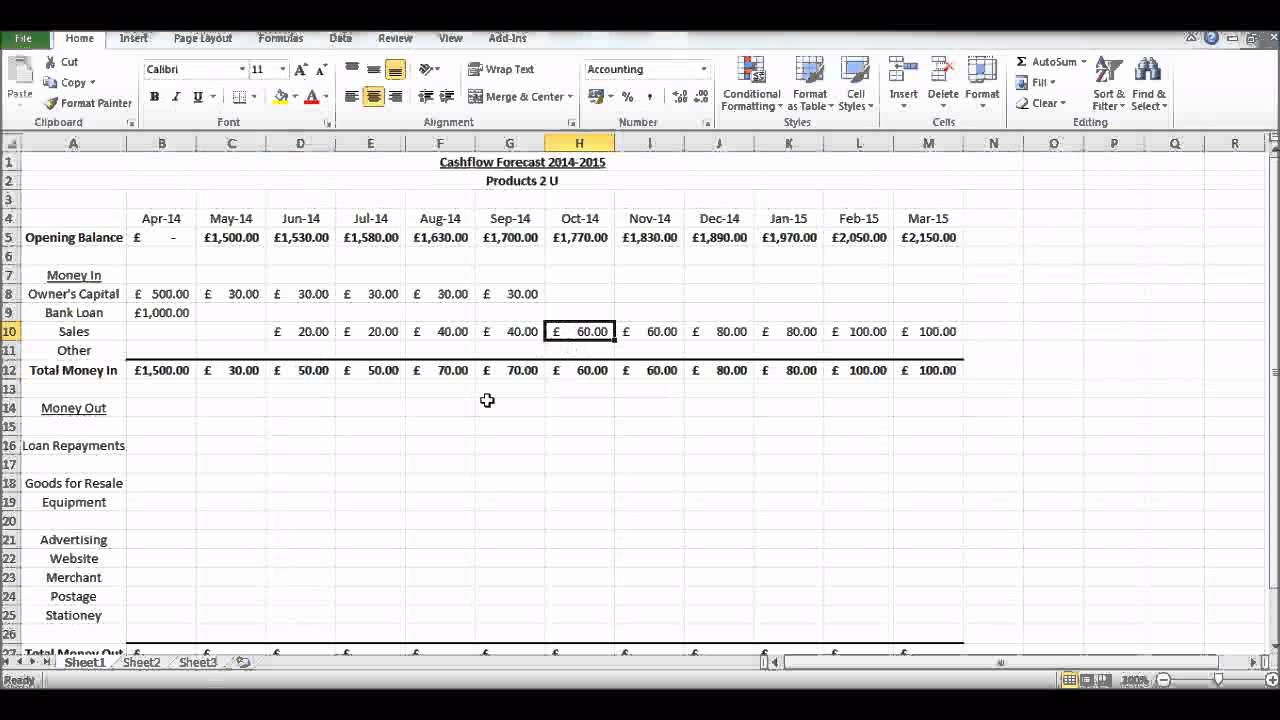

Operating Cash Flow Calculator. Operating Cash Flow (OCF) is a common financial measure to determine whether the company is able to achieve the required cash flow to grow its operations. It is useful for measuring the cash margin that is generated by the organization's operations. Cash Flow Calculator. Sales & Profits. Total Sales From First Month. How much will sales grow each month? What percentage of sales will be spent on the products you sell? (Cost of Goods Sold) What percentage of sales will be spent on operational expenses? Starting Balances. The HP 12c memory organization allows up to 20 different cash flow amounts plus the initial investment to be stored and handled according to the diagram in ...

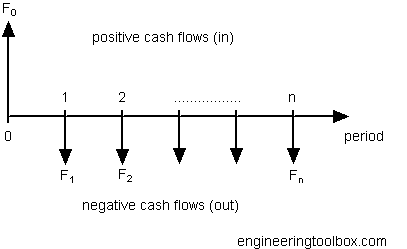

Cash flow diagram calculator. Free cash flow to equity – Also referred to as levered FCF. It's the amount of cash a business has after it has met its financial obligations. Examples of financial obligations covered by levered cash flow are operating expenses and interest payments. Analysts use variations of the FCF equation to calculate free cash flow to the firm or equity. The Present Value of the cash flows can be calculated by multiplying each cash flow with a Discount Rate. Present Value cash flow flow calculator; Cash Flow Diagram - Investment Transaction. An investment transaction starts with a negative cash flow when the investment is done - and continuous with positive cash flows when receiving the pay backs. This flow rate calculator uses flow velocity and cross-sectional flow area data to determine the volumetric flow rate of liquid. You can calculate the flow rate in five simple steps: Select the shape of the cross-section of the channel. Input all the measurements required to compute the cross-sectional area. Input the average velocity of the flow. 24 May 2021 — See your cash flow with our Cash Flow Calculator. An essential part of keeping a business running is adequate cash flow.

Example Cash Flow Problem. Starting in year 3 you will receive 5 yearly payments on January 1 for $10,000. You want to know the present value of that cash flow if your alternative expected rate of return is 3.48% per year. You are getting 5 payments of $10,000 each per year at 3.48% and paid in advance since it is the beginning of each year. Free Cash Flow. In corporate finance, free cash flow (FCF) or free cash flow to firm (FCFF) can be calculated by taking operating cash flow and subtracting capital expenditures. It is a method of looking at a business's cash flow to see what is available for distribution to the securities holders of a corporate entity. Using the Online Calculator to Calculate Present Value of Cash Flows. Go for an automatic tool to calculate PV of cash flows if you want to be sure that your calculations are quick and precise. A calculator will give you a detailed report about the present value of your future cash flows. These cash flows can be fixed or changing. The HP 12c memory organization allows up to 20 different cash flow amounts plus the initial investment to be stored and handled according to the diagram in ...

Cash Flow Calculator. Sales & Profits. Total Sales From First Month. How much will sales grow each month? What percentage of sales will be spent on the products you sell? (Cost of Goods Sold) What percentage of sales will be spent on operational expenses? Starting Balances. Operating Cash Flow Calculator. Operating Cash Flow (OCF) is a common financial measure to determine whether the company is able to achieve the required cash flow to grow its operations. It is useful for measuring the cash margin that is generated by the organization's operations.

A Calculator Labeled Cash Flow Lies On Financial Documents In The Office Stock Image Image Of Diagram Investment 210377989

0 Response to "37 cash flow diagram calculator"

Post a Comment